More than 200,000 children in Yorkshire and the Humber are living in 120,000 families trapped in problem debt, new research by The Children’s Society reveals.

It means more than one in six families with children in the region (18%) have been failing to keep up with household bills and loan repayments in the past year.

The evidence, based on a survey commissioned by the charity, also shows that families with children are more than twice as likely to have been trapped in problem debt as childless households.

In some cases children are going without basics such as food, clothing or heating, as well as suffering worry, anxiety and bullying.

The most common source of problem debt is arrears on energy bills, followed by loans from friends and family, bank loans, and council tax.

The Children’s Society has found that problem debt is putting stress on family relationships, damaging children and trapping families in a downward spiral of borrowing.

The Children’s Society, as part of its Debt Trap Campaign, is calling for changes to how creditors treat families with children who fall behind on bills and repayments. It is urging the Government to introduce a 12-month ‘breathing space’ scheme to give struggling families a period of protection from additional charges, mounting interest and enforcement action while they seek advice, put their finances in order, and get back on their feet.

Rob Jackson, Yorkshire and Humber Area Director at The Children’s Society, said: “Again and again we have raised the urgent problem of families who are trapped by debt, and whose children often pay the price with their mental and physical health.”

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Bradford Man Jailed For Child Sexual Offences

Bradford Man Jailed For Child Sexual Offences

Appeal After Burglary

Appeal After Burglary

Have your say and help to build stronger communities in Calderdale

Have your say and help to build stronger communities in Calderdale

Bradford to mark the 80th anniversary of D-Day

Bradford to mark the 80th anniversary of D-Day

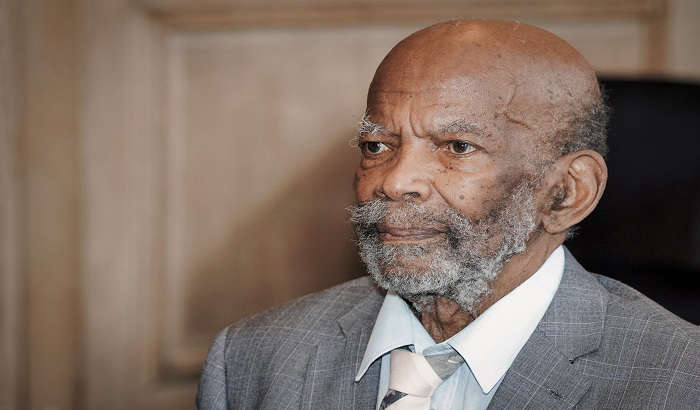

City presents Windrush pioneer with prestigious Leeds Award

City presents Windrush pioneer with prestigious Leeds Award

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

Plate expectations as historic registration could be up for sale

Plate expectations as historic registration could be up for sale

Calderdale: Celebrating over 350 years of service at Council

Calderdale: Celebrating over 350 years of service at Council

Activists who caused £100,000 worth of damage sentenced

Activists who caused £100,000 worth of damage sentenced

Appeal Following Collision and Death of Man in Otley, Leeds

Appeal Following Collision and Death of Man in Otley, Leeds

Remix Saturdays

Remix Saturdays

The Golden Era

The Golden Era

Alim OnAir

Alim OnAir

Legal Show

Legal Show