Mr Shiraz Ahmed has been disqualified for 11 years for taking part in a £2m plus VAT fraud.

Mr Shiraz Ahmed, a director of G Comms Ltd, a wholesale mobile phone business based in Ealing has been disqualified as a director by the High Court for 11 years for participating in contrived transactions with a view to gaining VAT refunds of over £2 million.

The disqualification regime exists to protect the public and Mr Ahmed’s disqualification from 27 July 2016 means that he cannot promote, manage, or be a director of a limited company until 26 July 2027.

This disqualification follows investigation by the Official Receiver at the Public Interest Unit, a specialist team of the Insolvency Service, whose involvement commenced with the winding up of the company, for unpaid VAT owed to HMRC.

The Official Receiver’s investigation uncovered that G Comms Ltd participated in a form of VAT fraud known as Missing Trader Intra Community fraud (MTIC, for short).

This missing trader fraud is commonly known as “Carousel” fraud, as large consignments of electrical or other small item size high value goods are invoiced rapidly and repeatedly around trading chains, speeded up by movement on paper, with actual movement of goods only taking place as they enter or exit the UK.

Such missing trader fraud indicators included the rapid succession of same day trades without deliveries within the UK of goods sitting at a shared freight forwarder, failing to conduct adequate due diligence on trading partners, failing to arrange adequate insurance on the goods etc.

Commenting on this case Paul Titherington, Official Receiver in the Public Interest Unit, said: "This type of VAT fraud is very serious and a high priority for HMRC and the Insolvency Service. MTIC fraud has been a great strain on the public purse and has cost the tax payer many billions of pounds in fraudulent VAT claims. The Insolvency Service is committed to making directors account for their actions."

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Bradford Man Jailed For Child Sexual Offences

Bradford Man Jailed For Child Sexual Offences

Appeal After Burglary

Appeal After Burglary

Have your say and help to build stronger communities in Calderdale

Have your say and help to build stronger communities in Calderdale

Bradford to mark the 80th anniversary of D-Day

Bradford to mark the 80th anniversary of D-Day

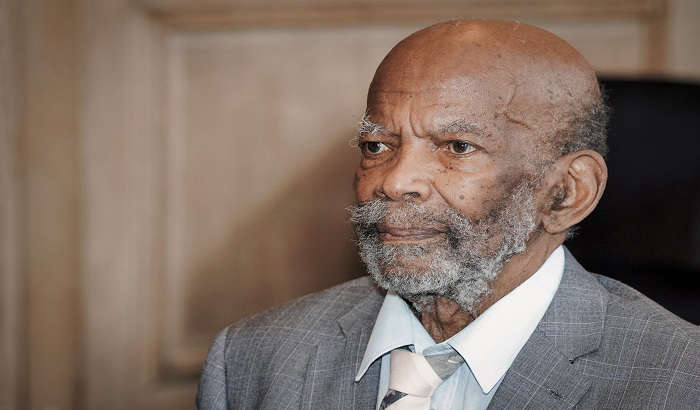

City presents Windrush pioneer with prestigious Leeds Award

City presents Windrush pioneer with prestigious Leeds Award

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

Plate expectations as historic registration could be up for sale

Plate expectations as historic registration could be up for sale

Calderdale: Celebrating over 350 years of service at Council

Calderdale: Celebrating over 350 years of service at Council

Activists who caused £100,000 worth of damage sentenced

Activists who caused £100,000 worth of damage sentenced

Appeal Following Collision and Death of Man in Otley, Leeds

Appeal Following Collision and Death of Man in Otley, Leeds

Legal Show

Legal Show

Alim OnAir

Alim OnAir

The Golden Era

The Golden Era

Remix Saturdays

Remix Saturdays