A 19-year-old man from Walsall has been jailed for selling fake motor insurance to unsuspecting customers, leaving them uninsured and illegally driving on the roads.

An investigation by the Insurance Fraud Enforcement Department (IFED), part of the City of London Police, uncovered his ‘ghost broking’ activity and found he was selling false car insurance via adverts placed on the Gumtree website. IFED officers also worked with colleagues from PSNI (Police Service Northern Ireland) and Leicestershire Police as they pieced together the full extent of his activity.

Azeem Mahmood Hussain of Broadway West, Walsall was sentenced to 12 months’ imprisonment at Wolverhampton Crown Court, having previously pleaded guilty to fraud by false representation.

Hussain’s deception first came to light on 9 July, 2013 after a man who unwittingly used Hussain’s service to insure his van was stopped by police in Northern Ireland. Checks on the vehicle revealed it was uninsured, but the driver protested and said that he was insured, having paid £200 into a bank account for the policy in response to a Gumtree advert. The case was eventually passed on to IFED, where officers made enquiries and identified the account as belonging to Hussain.

On 19 September, 2013 another victim attended a police station in Leicestershire to report that he had been defrauded of £1,000 after purchasing what he believed was genuine car insurance after seeing an advert on Gumtree. By this stage IFED detectives were on Hussain’s trail and the details were passed on to them to add to their investigation.

On 9 October 2013, IFED officers executed a search warrant at Hussain’s address, seizing mobile phones, a laptop, bank statements and debit cards. Hussain was also interviewed by officers the following day, where he denied any knowledge of the fraud.

However, officers found over 100 templates and forged documents on the laptop and the phones matched the numbers from the Gumtree adverts. Messages found on the phones showed conversations about arranging motor insurance policies, asking various individuals for details such as names, dates of birth and addresses.

Detectives also matched the accounts into which the victims had paid money to statements, debit cards and cheque books found at Hussain’s address. Officers found over £14,000 had been paid into one of the accounts, with £2,250 into the other. Most of the deposits into the accounts had references of names or registration numbers. When officers compared the reference names from the deposits into the account with the fraudulent certificates found on the laptop, they found several matches.

The majority of the forged certificates were made out to be policies from Allianz, although when officers checked with Allianz, they discovered none were recognised by Allianz as genuine policies. Officers also discovered that Hussain had added one of his customers onto a family member’s trade insurance policy with Tradewise Insurance. The driver was then involved in a crash and as he was listed on the trade policy, Tradewise was liable to cover the third party costs of around £10,000.

Hussain was charged on 7 March 2016 with four counts of fraud by false representation, and subsequently pleaded guilty to the offences on 3 May at Wolverhampton Crown Court.

Detective Sergeant Matt Hussey, from the Insurance Fraud Enforcement Department said:

“Hussain is one of the youngest ever people we’ve dealt with for insurance fraud and this was a crude attempt by him to make some fast cash from his bedroom. He was advertising cheap motor insurance deals on Gumtree and sadly he was able to con some people into thinking he was a genuine broker.

“I’d also like to thank colleagues from PSNI and Leicestershire Police for their help and assistance in this case, as well as Gumtree for their support in helping us to identify ghost brokers exploiting their website. Gumtree has since removed the insurance category from its website so that unscrupulous individuals like Hussain are no longer able to operate on there.

“Anyone who sees adverts for cheap insurance deals should always question whether it is legitimate – if it seems too good to be true, then it probably is. If you don’t have legitimate insurance, then you risk your car being seized by police or you could find yourself unprotected if you’re involved in a collision.”

Sarah Mallaby, Head of Technical Claims, Allianz Insurance said : “Scams such as these exploit members of the public and this significant sentence should send a message to potential ghost brokers that as an industry, we will fight against fraud every step of the way.”

Alison Middleton Operations Director for Tradewise Insurance said: “We are pleased with the outcome of the proceedings and it is a great example of collaboration between IFED, Tradewise and the insurance industry in our continual attempt to combat fraud. Ghost broking has a significant impact on both insurers and consumers with serious consequences as shown by the custodial sentence Mr Hussain received. Protecting our customers is vitally important and we continue to thoroughly investigate all claim and policy concerns, bringing perpetrators to justice.”

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Appeal Following Road Traffic Collision, Great Horton Road, Bradford

Bradford Man Jailed For Child Sexual Offences

Bradford Man Jailed For Child Sexual Offences

Appeal After Burglary

Appeal After Burglary

Have your say and help to build stronger communities in Calderdale

Have your say and help to build stronger communities in Calderdale

Bradford to mark the 80th anniversary of D-Day

Bradford to mark the 80th anniversary of D-Day

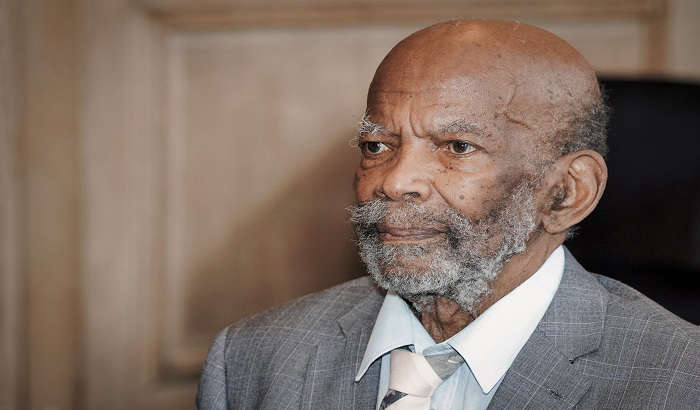

City presents Windrush pioneer with prestigious Leeds Award

City presents Windrush pioneer with prestigious Leeds Award

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

Plate expectations as historic registration could be up for sale

Plate expectations as historic registration could be up for sale

Calderdale: Celebrating over 350 years of service at Council

Calderdale: Celebrating over 350 years of service at Council

Activists who caused £100,000 worth of damage sentenced

Activists who caused £100,000 worth of damage sentenced

Appeal Following Collision and Death of Man in Otley, Leeds

Appeal Following Collision and Death of Man in Otley, Leeds

Remix Saturdays

Remix Saturdays

Alim OnAir

Alim OnAir

The Golden Era

The Golden Era

Bhangra Nights

Bhangra Nights